By Dr. Lewis Altfest, CFA, CFP®, CPA, PFS, Ph.D., Chief Executive Officer, Altfest Personal Wealth Management

By Dr. Lewis Altfest, CFA, CFP®, CPA, PFS, Ph.D., Chief Executive Officer, Altfest Personal Wealth Management

Why are corporate profits so important for your investments? What makes them especially key now?

Think of it this way: Your salary is what funds your household costs and for many people, allows growth in your standard of living over time. For corporations, the “salary” is the profit that they earn, which is paid out in the form of dividends or is reinvested in the business to enable the business to grow. Corporate profits are the single most important item for a company, challenged only by sales growth.

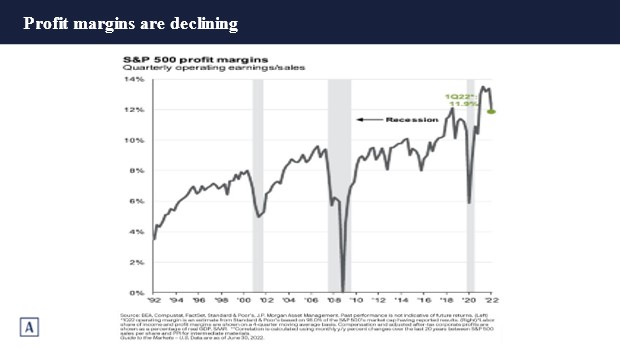

It’s crucial to understand why corporate profits are particularly important now, when stocks are down. At the same time, corporate profits today are very high relative to history and are projected to continue growing steadily over the next several years. To me, these profit gains are too ambitious – especially given the possibility of a recession. As the chart below shows, corporate profit margins are, in fact, declining again this year after recovering from a pandemic dip. I think the reasonable fair value for stocks today would no longer be appropriate if there was anything beyond a quick, flash recession.

Assuming no sizable, lengthy recession and realized projections of strong corporate profits, stocks are largely close to being fairly priced at present. Yet I would offer a few caveats.

Stock prices are fueled by corporate earnings

First, stocks don’t usually stop at fair prices. They usually decline even more. Second, any further rise in bond interest rates is likely to create more competition with stock market investing. Finally, the stock market is mostly fueled by current and projected company earnings. Any significant recession, unless over very quickly, will bring those earnings – and stock prices – down further.

So how can you make awareness of corporate profits work for your portfolio?

So how can you make awareness of corporate profits work for your portfolio?

In Altfest stock portfolios, we’re highlighting quality investments that have very strong market positions, low debt and a long-term growth trend within their companies. We’ve been able to buy some of these businesses’ stocks recently at very reasonable prices after sell-offs. We also have selected areas of investment outside the U.S. that are much more reasonably priced, with the dynamics of those markets differing from what we’re finding in the U.S. today.

Also, because we expect market volatility to continue until the Federal Reserve can get inflation under control, we recently added two hedging exchange-traded funds (ETFs) in the quarter, which have characteristics that will limit downside while giving upside exposure to the equity market.

Both stocks and bonds tumbled across the globe in the second quarter as sustained high inflation, rising interest rates and concerns about a potential recession caused a huge spike in volatility in financial markets. In this perilous climate, my firm’s consistent emphasis on value-focused investing already has made a positive contribution to our clients’ portfolio performance as we wait to see if inflation has peaked – or will continue to climb.

What does all this mean for your portfolio?

If you have questions or concerns about how corporate profits could affect your portfolio and the achievement of your financial goals in a time of inflation, please use the button below to set up a complimentary consultation.