By James Bassett, CFA, CFP®, Managing Advisor

Altfest Personal Wealth Management

What are some of the main questions about retirement planning that we typically get from professionals who come to our firm?

In fact, they range from, how much money do I need to have saved to retire, all the way to, can I leave my current position to go somewhere where I’m paid less and step back? Also typical: Is my portfolio in good shape? Are my assets well-protected so I’ll be safe in retirement no matter what happens in the markets or to me personally?

Really, what all these questions point to is: Am I ready?

I’m one of the managing advisers at Altfest, and I’d like to share with you a few pieces of timely retirement planning advice that we think anyone approaching retirement age can take advantage of. Here’s a quick list of the action items what I’m going to discuss:

- Know Your Starting Point

- Identify Your Destination

- Understand the Risks

- Put the Plan Into Motion

Know Your Starting Point

The first step is knowing what you’re starting with. When we first meet a new client, our job is to understand what assets they have accumulated to fill the tank for this possibly long journey through retirement. Just how should someone think through their own starting point to begin the retirement planning process?

It’s common to feel unsure as you approach retirement. There are a lot of professionals we work with—often accomplished doctors, dentists or lawyers—who come to us from a very predetermined, straightforward life path through education, launching their career, building a profession, practice or business. But now they’re approaching a period where things aren’t so certain. There’s not a single prescribed path to recommend for everyone.

People often look to CNBC or books for a simple solution. Yet I think answering clients’ questions about retirement planning always comes down to: It depends. It’s really personal.

So it’s best to start by gathering information about what your assets actually are. That can be everything from your professional salary to the retirement savings that you’ve put away to your home or maybe additional real estate that you’ve accumulated along the way, in tandem with the valuation of a practice or business.

The next stage is, of course, understanding your expenses: what you’re actually spending in your day-to-day life. This is critical to calculate as we approach retirement because this is what we’re going to fund. I always say it’s less important whether it’s going to charity or a restaurant, but expenses are essential to understand as you enter retirement so you can have a good projection.

Identify Your Destination

The second step is understanding and identifying where your destination is. What are the real goals that you want to accomplish in retirement? When you dig below the surface, there’s usually a lot more there to discover. Often, we hear clients just ask for a number. They think if they have a number, they have everything planned for.

Applying your goals, once we determine them, will affect the risk that you want to build into your portfolio and how you allocate assets to different types of accounts to make sure they’re the most effective, such as using a 529 plan for education savings, or a health savings account (HSA) for health expenses. All of this exploration contributes to executing on your goals—not just coming up with a money number but shaping the life that you’re seeking.

Understand the Risks

Third is having a solid comprehension of the risks. As you start your retirement journey, not everything’s going to go smoothly. It’s key to know what bumps you’re likely to come upon and how to use the tools at your disposal now to deal with them later on. If you can do something now to make life easier down the road, now is the best time to start thinking about it.

First, we need to factor in risks for unknown factors such as how long a client may live. Even if you have enough assets, it’s important to have a plan for access to them later in life for a variety of scenarios.

Next, what effect can inflation have over your lifetime? It may be different than you’ve typically heard it expressed on the news. Then, of course, we look at your investments. Ways to mitigate risk in the market or take advantage of it are very, very important.

Think about what we call “longevity risk,” or having a very long life. Among well-educated, high-net-worth Americans like many of our clients, we’ve found a 20% chance of at least one member of a couple living to age 95 or older. So it’s critical to have a plan for that possibly extended time period. Not just hoping it will work out, but having a way to access and use all the assets that you’ve saved when the time comes.

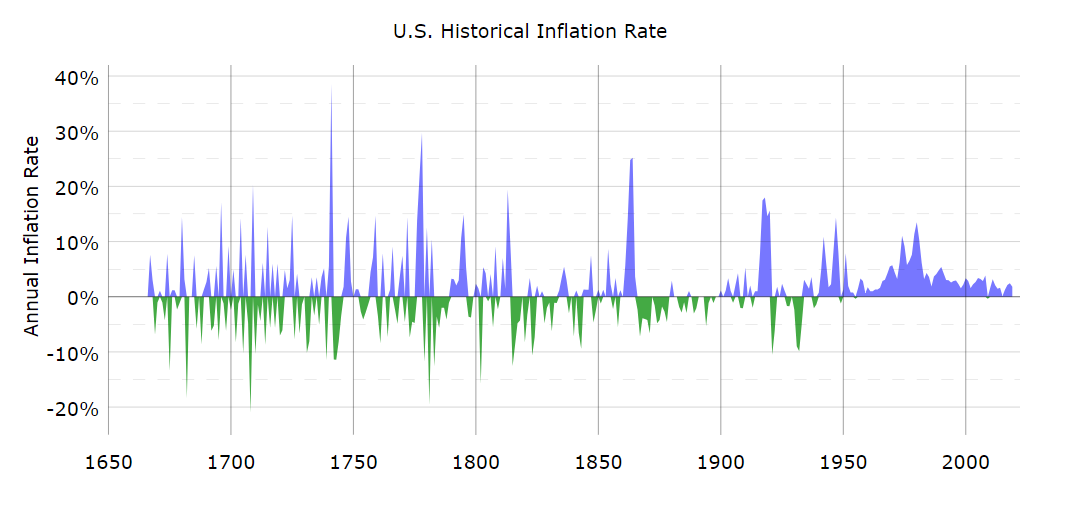

Planning for a potentially long lifespan, we must project how rising costs will come into play. If you look at the historical U.S. inflation rate chart below , there have been many big spikes, and those are what tend to be scare many clients.

However, it’s not the individual, significant spikes you need to worry about, but rather the accumulation of them down the line. When you’re thinking about how much you’re going to need in retirement, whether it’s $1 million, $2 million or some larger number, what that can pay for even on your basic daily expenses is going to be significantly lessened 10, 15 or 20 plus years into the future.

To deal with this prospect, you’ll want to allocate assets in your investment portfolio so you can get some growth and head off some of that inflation risk, especially if you have a long life. But, as you know, individual investments can run the gamut of performance, from high to low, and can whipsaw from year to year.

By having a cohesive portfolio that’s balanced and targeted to your risk tolerance, you can mitigate a lot of the market risks. Although history shows us that investing in stocks either can lead to a run-up of almost 50% or a drop of 40% in any one year, if you’re combining your stockholdings with other, broadly diversified investment options, you can bring that volatility risk down significantly.

Put the Plan into Motion

Now we’re ready to take all the factors we’ve discussed and put the plan into motion to prepare for retirement. Many people I speak with have a lot of ideas, and they plan and they plan, but sometimes the tangible facts of retirement get put off because they’re not ready to put a plan in motion. You can have the best planning in place, but sometimes when you gather all the pieces together, it can seem overwhelming.

We deal with retirement planning every day, so absolutely understand how overwhelming it can be. That’s why we make it our mission to be at each client’s side at every step of the journey, so you’re prepared for, and confident in, your retirement.

The other key thing is to make sure you work with someone who can account for the unknowns and help you project to cover either a specific fear or the fact that not every investment return or inflation number or salary increase is going to proceed like clockwork. We strive to lay it all out for you and think about what your unique projections look like.

After we’ve worked with you to identify your goals, we want to quantify them, including putting them into a long-term cash flow plan. What do the next few years look like for you? What does the short term look like? How about the longer term? Are you continuing to save money? For how long? At what point do you plan to step away from work? Is it going to be a complete withdrawal from work or is it going to be a phaseout with reduced hours and income for a while?

Some other things to consider: Are there any inheritances expected? Are you going to be selling the family home at some point? Are you going to be moving to another location? The money that you currently have in your portfolio, how’s that being invested? Is it invested according to your current goals and the further-out retirement goals we’ve identified? Is that money being optimized in the best risk-adjusted manner or is it too invested in a small part of the market, posing too much risk? Most crucially — is your portfolio out of alignment with your goals?

What about the risks in your life? They could include long-term healthcare expenses, long-term care expenses in the future or liabilities that you have, whether from creditors or potential lawsuits. And are there smart income tax planning strategies that you could be using but aren’t taking advantage of currently?

In sum, these are all aspects of our relationships with our clients that allow us to develop a deep understanding of what’s important to them, what their finances look like today and how we can best help them create a plan that allows them to be confident about achieving their financial goals. Finally, we work to put that plan into action and continue to monitor it over time as your circumstances change, laws change or even if your goals shift.

I hope this has painted—in broad strokes—the key action items you should be thinking about for your retirement. With that said, it is undeniably a lot. It’s no surprise that so many feel overwhelmed and keep putting of planning and taking action. In fact, unless you feel like taking on a second job doing all this planning and number-crunching, it might be fair to say that it is too much for a high-net-worth individual to tackle alone. That’s why Altfest exists and why I come into work every day.

Find Out More

At Altfest, we work to get to know who you are from the first consultation. We seek to find out what financial concerns are most important to you. Once we gain a solid understanding of your situation and aspirations for retirement, we’ll put together a road map to help you get to where you want to go.

If you’re not yet an Altfest client, please book some time for a complimentary consultation.