Planning NOW for Greater Estate Tax Exposure…+ NY’s Estate Tax Cliff

Planning NOW for Greater Estate Tax Exposure…+ NY’s Estate Tax Cliff

By Andrew Altfest & Mike Prendergast

Due to the overwhelming response of our webinar on estate planning and proposed legislation on June 4th with the New York State Dental Association (NYSDA), we at Altfest Personal Wealth Management are issuing a three part series to help you understand potential changes and evaluate your estate planning. This is the final article in that series.

As you may be aware, the advantageous federal gift and estate tax exclusions currently in place are likely to disappear soon. Proposals in Congress seek to sharply curtail the amount one can gift or transfer in one’s lifetime or at one’s death — an avenue that has helped Americans with substantial assets avoid having them heavily taxed upon life transfers and death.

Under current law, the gift tax and the estate tax exemptions are unified, so in total in 2021, you can pass or transfer up to $11.7 million as a single person and $23.4 million as a married couple during your lifetime, or upon death. However, new draft legislation called the “For the 99.5% Act” from U.S. Sens. Bernie Sanders (I-Vt.) and Sheldon Whitehouse (D-R.I.) that’s aimed at addressing wealth inequality could significantly cut how much you can gift or transfer in this way.

If enacted, the law could slash lifetime gifts and transfers to as low as $1 million per single person and $2 million per married couple. It also hikes the rate at which a greater proportion of your estate will be taxed. The financial implications of this bill and similar ones in Congress can’t be overstated.

At Altfest Personal Wealth Management, we’d like to share some ideas that can help you prepare for a potential upheaval in beneficial estate planning. Many observers expect change in some form to come even before the end of 2021, so there’s an immediate need to evaluate your plan.

Create a Trust in the Near Future

One solution we recommend is forming an Intentionally Defective Grantor Trust (IDGT) soon, if you have more than enough assets to last your lifetime. This approach uses the current high lifetime gift tax exemption amount before it is eliminated and shifts these assets and their future growth out of your estate so they aren’t burdened with tax upon your death. Be aware that the 99.5% Act eliminates the value of IDGTs because it makes the trust grantor, or creator, the owner of the trust property for income tax and estate tax purposes. Current law allows estate tax to be avoided for assets transferred into a properly drawn IDGT.

Establish a Spousal Trust

Alternatively, you could consider setting up a spousal lifetime access trust, or SLAT. In this option, the donor spouse uses some or all of the current gift-tax exemption to fund the SLAT for the beneficiary spouse, while giving up direct access to the funds in the SLAT. The donor spouse does not claim the marital deduction for this transfer but does retain indirect access to the funds via the disbursements to the beneficiary spouse, as he or she spends that money on housing, food and utilities, etc. (the grantor gets an indirect benefit if the couple is living together). The property in a properly drawn SLAT is not taxed in the estates of either the donor or the receiving spouse.

An Altfest advisor can also walk you through the specifics of this course of action, if appropriate.

Redistributing Assets to Your Advantage

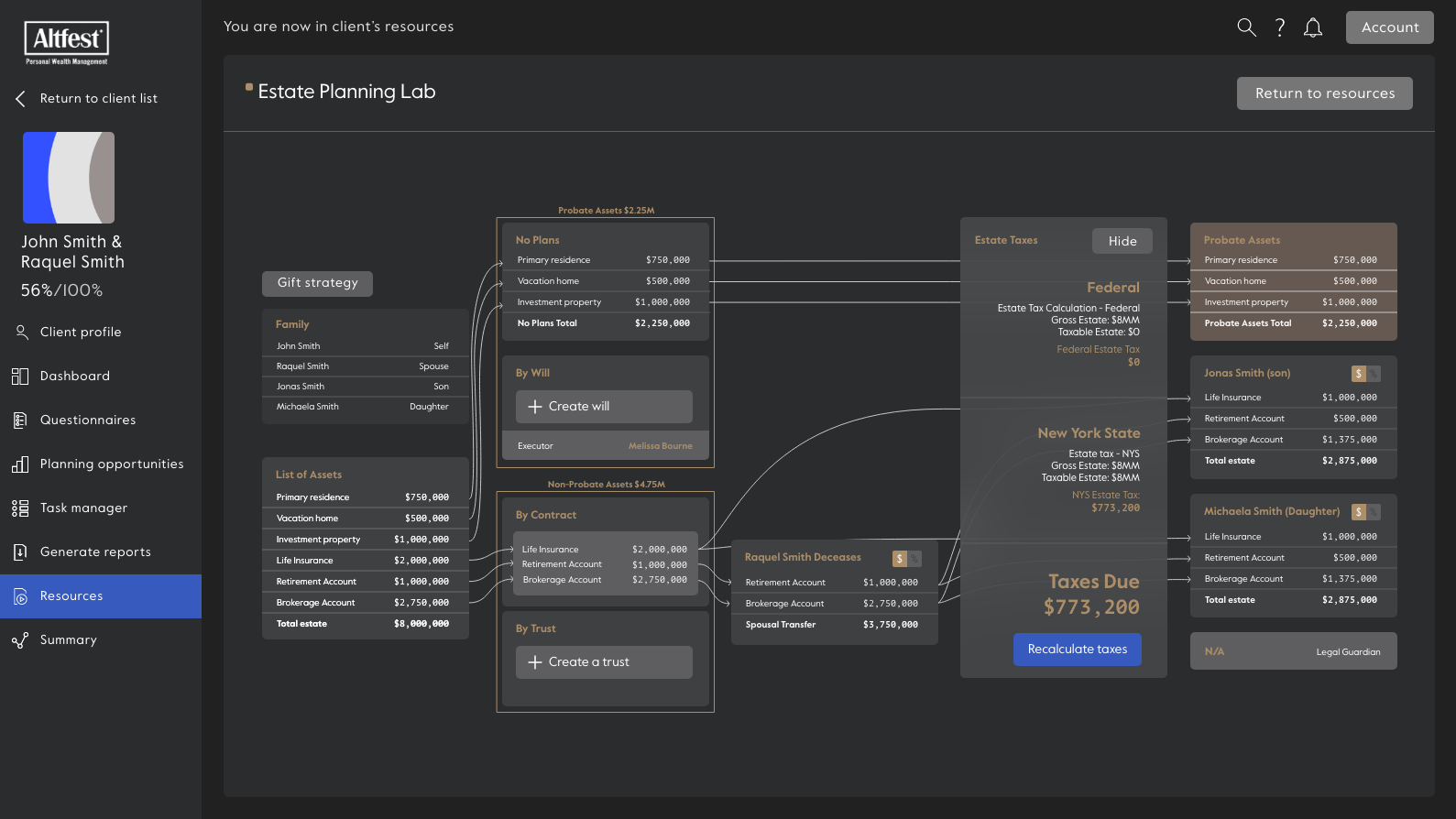

How do these strategies preparing for lower estate tax thresholds work in real life? Here’s an illustration of how near-term planning might look for a hypothetical couple who live in New York state, where estate tax laws pose an unusual threat for some. When a New York estate exceeds the state’s current exemption amount of $5.93 million by greater than 5%, the entire estate is subject to New York estate tax.

In this theoretical case, assume that together, a couple’s assets, including real estate, investments, retirement accounts and life insurance policy proceeds, total about $8 million, which puts them over the reduced couples’ federal exemption level of $7 million if the 99.5% Act passes in its current form. Most of their assets are in one spouse’s name, and a considerable amount are set to pass contractually, meaning outside of probate, to designated beneficiaries. They have adult children who would inherit upon the second spouse’s death.

But this arrangement could pose a major disadvantage. In New York state, each spouse has an exemption level, but that is lost upon the first spouse’s death if its use isn’t planned in advance. So it often makes sense to set up a credit shelter trust or at least a disclaimer trust giving the surviving spouse an option to disclaim to a trust upon the death of the first spouse. That trust can be funded to preserve the first-to-die spouse’s New York estate tax exemption and shield the surviving spouse from the burden of having failed to use the state tax exclusion at the first death.

Altfest worked with the couple’s attorney to retitle their assets more evenly between spouses to use both their exemptions for state estate tax. There’s no New York estate tax owed once the assets are transferred for the benefit of the surviving spouse via the trust. If directly transferred to the surviving spouse, who only has the $5.93 million exemption in New York, a state tax liability upon his or her subsequent death must be dealt with. But this can be avoided by funding the disclaimer trust instead.

In this scenario, it’s important that the assets be evenly distributed between spouses to benefit. Here, the husband had the vast majority of assets in his name. Even with a disclaimer trust being set up, if his wife were to pre-decease him, there would be little opportunity to fund a disclaimer trust. Unlike the federal estate tax, which permits portability of the unused available exclusion between spouses, New York does not recognize portability for its estate tax. One must use the exclusion at each death – or lose it. Life insurance can also be gifted to a trust. We also worked with their attorney in this case to set up a lifetime trust for their children that provides them with creditor protection whether from divorce, lawsuit risk or otherwise.

In addition, we helped reorganize the couple’s investment property, which was owned by a business. It was re-formed into controlling and non-controlling interests, and then the couple was able to gift the non-controlling interest to a trust for their children to remove future appreciation from their estates, while they still receive income from the investment assets.

When you reorganize your assets in this way, you can use allowable discounts to make gifts today and claim a value below the current market value. So, if an investment property is valued at $1 million and you gift 40% of it to a trust, you don’t have to count the gift as $400,000. A 30% discount would result in a reportable value for gift-tax purposes of $280,000 for the gifted property. This type of planning is called minority-interest planning, and it — along with valuation discounts — is under pressure by the 99.5% Act and other legislative proposals.

As you can see, this example is very timely, and, if applicable, could be a smart model for re-evaluating your own estate plan now.

Speak with a Financial Professional

Planning for the proposed changes from Congress and how they might affect your estate, large gifts and taxes can be overwhelming. Look to Altfest for help in better understanding how the 99.5% Act or other proposed legislative changes might radically alter your estate and gifts taxation and build a new estate plan in accordance with the new legislation to help shape and realize financial goals. Schedule a complimentary consultation with Altfest.

Disclaimer: Information provided is for educational purposes. Altfest does not provide tax, legal, or accounting advice. In considering this material, you should discuss your individual circumstances with professionals in those areas before making any decisions. Further, your advisor makes no warranties with regard to such information or a result obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.