Steering Your Portfolio Through Turbulent Times: Ideas for Medical Professionals

Steering Your Portfolio Through Turbulent Times: Ideas for Medical Professionals

As any investor in the U.S. is keenly aware, the financial markets have been whipsawed by volatility in the last few months. The market declines do have some historical precedent, though, and the ups and downs can be viewed as creating some attractive opportunities. Let’s start by focusing on the medium- to longer-term outlook for market turbulence, and some ways you as a medical professional can navigate this uncertain time.

Look Outside the U.S. Stock Market for Value

It’s good to be aware of positive returns being delivered by many non-U.S. stocks so far this year. This can be attributed in part to what we call an expansion of multiples. A price-to-earnings multiple is what a stock investor is willing to pay for each dollar of company earnings. With many international stocks, people are now willing to pay more for their earnings than they were at the beginning of the year. A couple of factors drive this. One is that foreign markets are realizing they must be less reliant on the U.S., given that the U.S. appears to be isolating itself more from the rest of the world and trying to manufacture more domestically, for example.

So these markets, especially within Europe, are now facing the prospect of driving more growth by themselves and even beefing up their defense spending internally when not relying on the U.S. as much. As such, the markets are seeing these factors as being pro-growth for non-U.S. markets as they need to spend more to bolster their economies — which could be a good thing for the companies based outside the U.S.

Higher returns aren’t only coming from Europe, but also from China, other emerging markets, even Japan. And, interestingly, when you look at the current valuations of these different markets, it’s clear that, while they are broadly higher than they were at the beginning of the year, especially in Europe, they’re still much cheaper than the U.S. stock market. This priciness of earnings multiples in the American market has made us at Altfest Personal Wealth Management a bit cautious toward how we’re investing in the U.S. when it’s trading more expensively than it has historically.

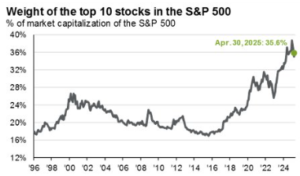

And not only are we concerned about high U.S. stock valuations, we’re also watching the concentration within our domestic stock market. The chart below gives you a sense of what share of the market the top 10 stocks have made up within the S&P 500 Index over time, over the past roughly three decades. And you can see that it has very quickly risen over the past decade or so to the point where now the top 10 stocks represented more than 35% of the market as of the end of April.

Source: J.P. Morgan Asset Management.

There are concerns that the makeup of those top 10 stocks is not that diverse. For the most part, the biggest and best stocks — the most profitable ones — are all tech stocks in the U.S. market. Today, when you’re buying the S&P 500, you’re mostly buying technology companies. And over the past decade or more, since the Great Financial Crisis, that’s really paid off very nicely. But these sorts of themes in which a certain group of stocks outperforms for a long time don’t necessarily continue forever. We’ve seen points in history where the best company and the best stock of the day have really fallen significantly decades later to end up greatly underperforming the rest of the market, and shareholders end up disappointed if they stayed with some of those names. In general, loading up on one area of the market that might later underperform badly can be a risky thing to do, and the same is true today.

What Do Inflation, Tariffs and the Deficit Mean for Me?

Let’s also consider inflation as part of the market’s unpredictability now. It’s really been a key headline since about 2022, when inflation and interest rates rose markedly. Since then, we’ve seen both come down to a more modest 2% to 3% range. But you might be asking, “Where is inflation going? How might that feed the volatility in the financial markets?”

Tariffs have been a key driver of headlines this year. At our firm, our thinking is that tariffs will be a short-term drag on growth within the economy, if they are put in place. If they last any length of time, there likely could be a growth slowdown induced by tariffs that might offset some of the tariffs’ inflationary effects. So, in our view, tariffs themselves wouldn’t bring high inflation immediately, but we do have some concerns that inflation could pick up later in the year. The reasons include more tax cuts that might result from legislation now being considered, and the impact of reduced regulation across the economy. Those two factors could be just as important or more so than tariffs, in terms of their effect on inflation.

Another worry is the government deficits that we’re running on an annual basis and the ever-growing debt that our government has. The cost of servicing this debt has grown significantly. As a U.S. citizen, you might say, “Well, this isn’t directly impacting me any time soon,” but it certainly may become real to you if you are an investor in fixed income or bonds. U.S. government debt, which takes the form of Treasury bonds or notes, is fully affected by the budget of the federal government and its ability to repay on its interest. For now, the U.S. is still considered the highest-quality debt payer, even with a recent downgrade to our debt rating by Moody’s.

Possibly, the longer-term thing to be concerned about with these growing deficits and debt is that down the line we are forced to have more fiscal discipline, whether that means higher taxes or less spending or a combination of both. Those things would contribute to or cause less growth for the economy overall and possibly lower profits for U.S. companies. So, over time, having more fiscal discipline required could lead to poorer stock market returns. That’s something that must be considered when we’re thinking about long-term investing and cash flow, as well as retirement planning.

Some Good News Amid the Volatility

There are some positives beyond the risks we’ve discussed that come from a volatile investing environment. The first is interest rates. We’ve had rates that were historically low for a good while since the financial crisis. Rates were slowly coming up right before COVID, and then the pandemic forced the Federal Reserve to act and push rates down close to zero again.

In 2022, we experienced a very sharp rise in interest rates in an attempt to tame inflation and cool the economy coming out of COVID. Since then, interest rates have remained somewhat high. And in the immediate future, the Fed will very likely hold off on lowering rates until there’s a clear and substantial weakness seen in the labor market. Both the Fed and the market expect that interest rates will come down from the current level of about 4.4% to closer to 3% over the next three years.

How that might affect you will depend on your situation. Even if you expect the short-term interest rate to fall in the next couple of years, that doesn’t necessarily mean your mortgage will also come down in tandem, as that’s more driven by market expectations of inflation and growth over time.

The possibility of a recession has fluctuated lately. JP Morgan recently put the chance of one happening this year at a little less than 50%, when previously that estimate was much higher. One takeaway I’d like to offer is that the severity of a recession, if we have one, does not necessarily tell you about subsequent stock market performance. Just because we have a recession does not necessarily mean stock markets will perform poorly. And that is something that’s hard to wrap your head around.

We’re also looking at the possibility of lower taxes. Overall, tax cuts would mean more take-home pay for a lot of people and that would be pro-growth, in our mind. So, in the short term, tax cuts could mean higher growth, and maybe the stock market will respond positively to that. But over the longer term, this feeds into fiscal deficits and the level of interest our country’s paying.

How Asset Classes Are Performing Now

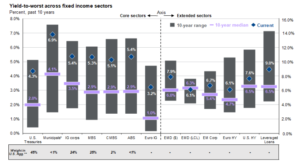

Bonds. These fixed income investments most likely are a part of your portfolio, whether small or large. As of now, bonds continue to offer much higher interest rates and yields compared with what they’ve been delivering over the past 10 years.

Source: Bloomberg, FactSet, J.P. Morgan Credit Research, J.P. Morgan Asset Management

You can see by the blue diamonds in the chart above that current interest rates are sitting far higher than their 10-year averages and are currently at the top end of their 10-year range. Meaning you continue to see yields, for example, in Treasurys of 4% or more at times. Not only that, we’re seeing pretty attractive yields in the municipal bond market, which we refer to as “munis,” as shown by the second bar from the left, on what we call a tax-equivalent basis. After figuring in the fact that you get municipal bond yields on a tax-free basis, their tax-equivalent yields are actually much higher than Treasurys if you’re in a very high income-tax bracket, both federally, state and local. Munis are an area where we’re finding some good opportunities for our clients, depending on their state of residence.

As it relates to bonds, inflation over the medium to long term remains a concern, however. There are Treasury bond instruments called Treasury Inflation-Protected Securities, or “TIPS,” that can give you some inflation buffer during times like this. They will outperform traditional Treasury bonds if inflation ends up being higher than expected.

Stocks. Even though non-U.S. markets are up by double digits this year and the U.S. stock market is not, we’re still seeing a large gap in international valuations relative to their long-term average compared with the U.S. and its elevated stock valuations.

Source: MSCI, J.P. Morgan Asset Management

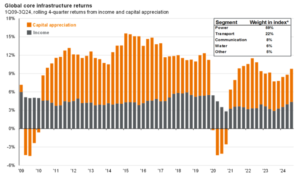

Alternative investments. Infrastructure investments are one type of alternative investment beyond the traditional options of stocks, bonds and cash. In the chart below, you can see infrastructure investments have a much higher component of what we call income, or dividend yield, that is getting paid out as a portion of their returns.

Because many of these infrastructure assets, like utilities, toll roads and railroads, are income-producing investments that aren’t necessarily reinvesting all profits back into their business, they’re going to pay out more of it to you.

The possibility for capital appreciation going forward, represented by the orange bars, we think remains strong with infrastructure investments, so it can be worthwhile to include them in a diversified portfolio.

Using Diversification to Calm the Storms

We at Altfest strongly believe in diversification for most investors, yet the levels of stocks and of bonds that you hold can be very dependent on your situation and your stage of life. The longer the timeline, the more you can expect that your diversified portfolio’s returns will remain in a defined range that stays more certain — even when there’s occasional volatility — than they will over a short-term horizon. This idea comes into play when we’re talking about retirement planning and cash-flow management with our clients.

Finally, beyond your portfolio strategy, there are some things you should think about simply because your financial plan is not your investments alone. For instance, you might be quite concerned about one or more worst-case scenarios and what they’d mean to you. It could be a very large long-term care expense in the future as you age; it could mean an immediate and damaging market downturn right as you’re retiring. If for some reason you aren’t confident about how your finances would hold up if faced with your worst-case scenario, then your advisor can suggest things in your control that could be adjusted: perhaps the ability to work just a bit longer, or ways to temporarily reduce some expenses.

Beyond the numbers, it’s crucial for you to be sure that you feel empowered about everything in your life and how you are spending to make sure your values are aligned with that — which is something we can assist with using tools that we have.

Financial Support for Medical Professionals

At Altfest, we strive to understand what you’re about and what matters to you from the first consultation. We can help envision and project the best outcomes for you, based on your worst-case scenarios, goals, current assets and expected income and expenses. Our advice can contribute to a sense of security in a turbulent market through careful, innovative financial planning. We have over 40 years of experience guiding physicians and dentists in their personal finances.

If you’re not yet an Altfest client, you can request a complimentary consultation with one of our experts.

Investment advisory services provided by Altfest Personal Wealth Management (“APWM”). All written content on this site is for information purposes only. Opinions expressed herein are solely those of APWM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Ryan Graham, CFA, CFP

Ryan works with clients and their families to develop and implement financial plans designed to achieve their personal and financial goals. In addition, he serves as an analyst for developed international markets and develop the Corporate Trustee Solution at the firm.

Prior to joining Altfest, Ryan worked at PwC as a risk consultant in financial services. Ryan earned degrees in both Finance and Accounting at the University of Arizona, and holds the CFA and CFP® designations. He is a member of the CFA Institute and CFA Society New York.