Next Round of PPP Loans Aimed at Small Businesses: Does Your Business Qualify?

Next Round of PPP Loans Aimed at Small Businesses: Does Your Business Qualify?

By Ekta Patel, CFP®, MBA, Director and Advisor

If your business has been impacted by the pandemic, some new relief may be available. But it’s critical to apply soon,

By Ryan Graham, CFA, CFP®, Senior Financial Advisor

because the deadline is March 31.

Congress in December approved a $284 billion restart[1] to the Paycheck Protection Program (PPP) for small businesses struggling to make payroll and other business expenses because of COVID-19 hardship. This funding to support ongoing business operations is available to both eligible new applicants and borrowers who participated in the first round in 2020. The latest round is aimed at providing relief to the most-damaged businesses and practices,

and the criteria to qualify for the second disbursement are somewhat stricter.

Eligibility Limited to Smaller Businesses

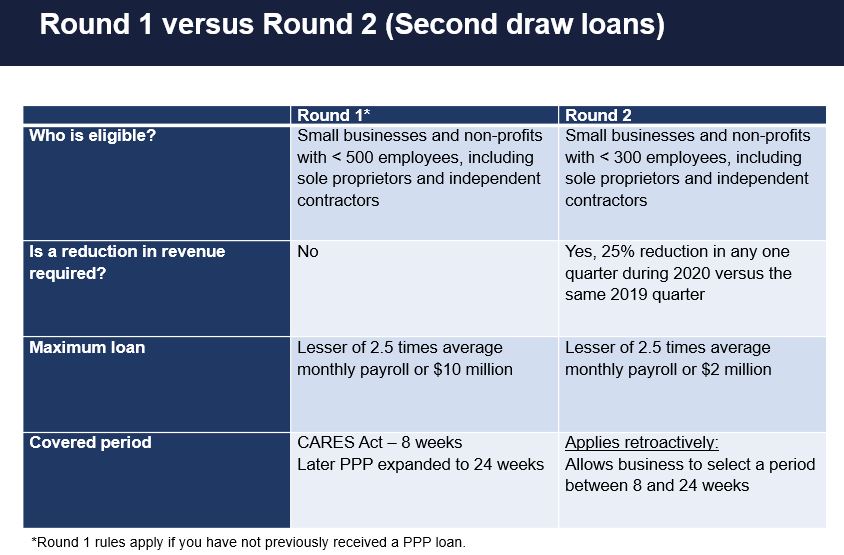

This time, PPP loans are available just for eligible small businesses and nonprofits with fewer than 300 employees, including sole proprietors and independent contractors. Applicants for this round must demonstrate a 25% or greater reduction in gross receipts—not net profit—during any one quarter in 2020 versus the same quarter in 2019. That requirement wasn’t part of the first round of PPP assistance. Second-round applicants also must demonstrate that all money received in the first round of PPP was used in permitted ways.[2]

The maximum loan amount for second-time borrowers (other than sole proprietors, who have a different calculation)[3] is the lesser of 2.5 times average monthly payroll or $2 million. (Restaurants and hotels are allowed 3.5 times average monthly payroll, by comparison.) In the first round of PPP, larger loans of up to $10 million were granted.

Note that if you’re applying for PPP for the first time in early 2021, Round 1 eligibility rules still apply, and that more sizable loans for borrowers with a bigger payroll are available (see table below):

Forgiven Loan Proceeds Remain Deductible

Several important new allowances come with this second round of PPP support. At the top of the list – practice expenses paid with the proceeds of forgiven PPP loans will remain tax-deductible. States will need to reconcile their tax laws with the federal rules relevant to these loans.

Forgiveness in this round continues to be offered for at least 60% of the loan if used for payroll and for up to a maximum of 40% of non-payroll business expenses.

Further, more eligible expenses are included and treated as retroactive to CARES Act funding that started in April 2020. One welcome development here is that payroll costs being covered by PPP loans can now encompass group insurance expense. The loans can also be used to cover COVID-related safety gear, barriers and other protective measures taken for staff.

In this latest round of lending, borrowers can choose to spend the money during any period ranging from 8 to 24 weeks. And applying for this forgiveness for loans up to $150,000 is now much easier, as it will require less documentation.

Loan amounts not forgiven carry a 1% interest rate and a five-year repayment term, in most cases.[1]

Calculating Your Loan Amount

This time, the following formula should be used by business owners applying to a bank or fintech platform for more PPP assistance (it may be easiest to approach the same lender that extended your first PPP loan if you’re applying again).

Take your average monthly payroll over the previous one year, in other words, total payroll for the year divided by 12 months. Then multiply the monthly average by 2.5. If you’re applying in early 2021, use the 2020 calendar-year payroll, or, as an alternative, you can use 2019’s average monthly payroll amount.

Also keep in mind that loan forgiveness is available for the lesser of either covered expenses or payroll expenses, divided by 0.6.

It Can Help To Speak with a Financial Professional

Relief measures related to the pandemic, including the second round of PPP loans, may be right for your practice. Looking to discuss eligibility for this federal assistance, or another financial topic? Schedule a complimentary consultation with Altfest online, or contact Jesse Frehling at (212) 796-8732 or jfrehling@altfest.com.

About Altfest

Altfest specializes in providing comprehensive wealth management services tailored to healthcare professionals. Altfest’s advisors integrate custom financial planning with investment management in order to address all elements of an individual’s finances. Altfest serves individuals and families as a fee-only fiduciary and is one of the leading registered investment advisers in New York and the United States. Altfest was founded in 1983 and currently has $1.5 billion in assets under management. Information is provided for educational purposes only. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

If you would like to schedule a complimentary consultation with Altfest, please click the following link to schedule: Schedule a Meeting with Altfest

Or, please contact Jesse Frehling at jfrehling@altfest.com or (212) 796-8732.

[1] https://www.nytimes.com/2021/01/14/business/ppp-loans-questions.html

[1] https://www.nytimes.com/2021/01/14/business/ppp-loans-questions.html

[2] https://www.nytimes.com/2021/01/14/business/ppp-loans-questions.html

[3] https://www.nytimes.com/2021/01/14/business/ppp-loans-questions.html

[4] https://www.nytimes.com/2021/01/14/business/ppp-loans-questions.html

Altfest does not provide legal, tax, or insurance advice. You should consult with your professionals in these fields to address your specific circumstances.

Altfest may provide general information about income tax, insurance and estate planning for discussion purposes only. Altfest makes no representations or warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any position taken in reliance on, such information. You should rely solely on the advice of independent professionals or other sources separate from Altfest before making any decision relating to income taxes, insurance, estate planning and related issues.